Инвестициялық пай қоры

Қаржыңызды басқаруды кәсіби мамандарға тапсырыңыз және тұрақты дивидендтер алыңыз. АҚШ долларында 5% және Теңгеде 16% мақсатты кірістілікпен пай қорларына инвестициялаңыз.

Зейнетақы активтерін басқару

Өзіңізді лайықты зейнетақымен қамтамасыз етіңіз. Зейнетақы жинақтарының бір бөлігін жылдық 16% мақсатты кіріспен сенімгерлік басқаруға аударыңыз.

Компания жаңалықтары

Барлық маңызды жаңартулар мен оқиғалар туралы хабардар болыңыз. Хабарландыруларымыз бен жаңалықтарымызды қадағалаңыз. Жаңа өнімдер мен қызметтермен танысыңыз. Біздің жетістіктеріміз бен болашақ жоспарларымыз туралы біліңіз.

Жоғары табысты облигациялар

Жоғары табысты облигацияларда АҚШ долларымен 11%-ға дейін және Теңгемен 25%-ға дейін табыс табыңыз. Сенімді эмитенттердің қаржы құралдарына инвестиция салыңыз.

Жеке Брокер

Қаржыны табысты басқару үшін тәжірибе мен уақыт қажет. "Жеке Брокер" қызметінде қор нарығында 10 жылдан астам жұмыс тәжірибесі бар жеке кеңесшіңіз болады, ол қалауыңыз бен мақсатыңызды ескере отырып, Сіз үшін жеке стратегия әзірлеуге көмектеседі.

Telegram BCC Invest

BСС Invest корпоративтік телеграм каналымызға жазылыңыз және қаржы әлеміндегі соңғы жаңалықтардан хабардар болыңыз.

Біз арна оқырмандарымен инвестицияларға арналған пайдалы идеялармен, белгілі бір оқиғаларға көзқарастарымызбен, аналитикалық шолулармен бөлісеміз.

BCC Invest - IPO AIR Astana бірлескен андеррайтері

2024 жылдың 29 қаңтары мен 8 ақпаны аралығында жүргізілген Air Astana IPO аясында, BCC Группасы ("Банк Центркредит" АҚ және "BCC Invest" АҚ) инвесторлардан 30 миллиард теңгеден астам сомаға (72 миллион долларға баламалы) өтінімдер жинады. Бұл "Air Astana" компаниясының ішкі нарықтағы IPO аясында жиналған барлық өтінімдердің жалпы көлемінің 33% - дан астамын құрайды. Көлемнің көп бөлігі жеке инвесторлардан (жеке тұлғалардан) келді.

ИАПҚ "Разумный баланс" 2023 жылы

ИАПҚ "Разумный баланс" табыстылығы жыл басынан бері және 1 желтоқсандағы жағдай бойынша теңгемен 14,94% құрады. Қордың негізгі активтері қазақстандық және халықаралық эмитенттердің облигациялары, ақша нарығының құралдары мен акциялары болып табылады.

₸110 млрд.

2023 жыл басынан бері 110 млрд теңге, BCC Invest командасы KASE платформасында жалпы сомасы 110 млрд теңгеден астам борыштық бағалы қағаздарды орналастыру бойынша 29 транзакция ұйымдастырды.

Жаңалықтар

Жазбаша нұсқама түріндегі қадағалау ден қою шараларын қоғамға қолдану туралы

Жазбаша нұсқама түріндегі қадағалау ден қою шараларын қоғамға қолдану туралы

Өту

Назар аударыңыз: 2024 жылғы 14 қазанда валюталық аударымдарды жүргізудегі өзгерістер

Назар аударыңыз: 2024 жылғы 14 қазанда валюталық аударымдарды жүргізудегі өзгерістер

Өту

Қоғамға қадағалап ден қоюдың ұсынымдық шарасын қолдану туралы

Қоғамға қадағалап ден қоюдың ұсынымдық шарасын қолдану туралы

Өту

Неліктен бізді таңдайсыз

26 жыл

Қаржы нарығындағы ең бірінші инвестициялық компаниялардың бірі

₸78,8 млрд

Меншікті активтер бойынша ТОП 2

~34%

Жеке инвестициялық қорлардағы және ашық пайлық қорлардағы басқарудағы активтердің нарықтық үлесі

₸5,1 млрд

Басқарылатын зейнетақы активтері бойынша Топ-3

ТОП 3

KASE-де 30 құралы бар маркет-мейкер

~₸155 млрд

Корпоративтік облигациялар нарығындағы 2023 жылдың үздік андеррайтері

Аналитика

19-10-2024

Қытай экономикасы Үкіметтің экономика мен ішкі тұтынуды ынталандыруы аясында қалпына келтіру жолында. Қытайдың Интернет-компаниялары интернет-коммерциядағы жоғары экспозицияға байланысты тұтынудың өсуінің негізгі бенефициарлары болып табылады. ETF

12-09-2024

Обновление стоимости АО «НАК «КазАтомПром» по результатам отчетности за 1 полугодие 2024 года.Согласно нашей модели, мы уменьшили стоимость одной акции в 21 258₸, с потенциальным ростом в 18% от текущей рыночной цены, с оценкой «Покупать

05-09-2024

«KEGOC» АҚ 2024 жылдың 1 жартыжылдығындағы қызметтің операциялық нәтижелерін жариялады. Біз бір жай акцияның құнын 1 778 теңге деңгейінде, «buy/сатып алу» бағасымен сақтадық және 2024 жылдың нәтижелері бойынша қаржылық есептілікті ұсынғаннан кейін

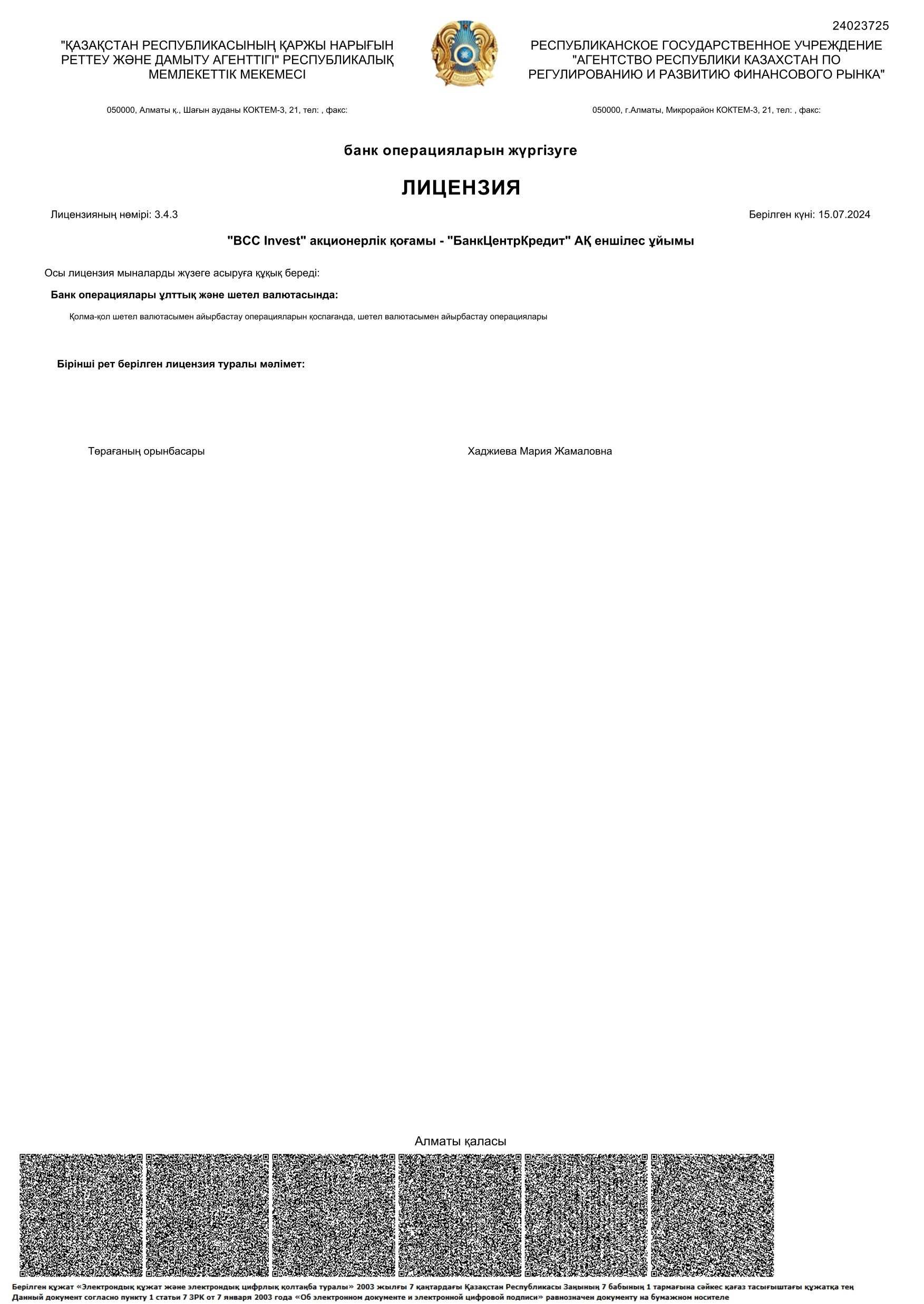

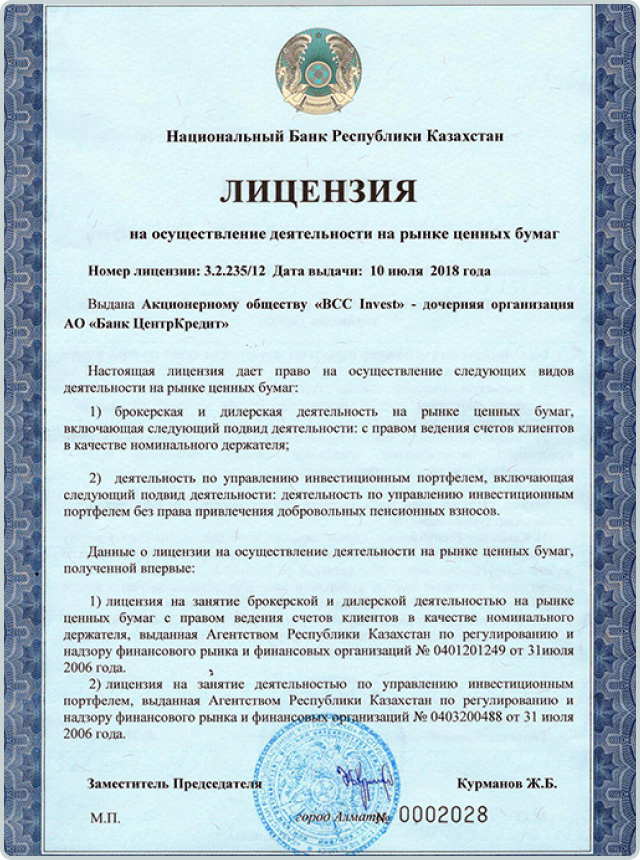

Марапаттар мен лицензиялар

Біздің серіктестер

Қазақстан, A05G1D2, Алматы, Панфилов-98, © 2024 «BCC Invest» АҚ Бағалы қағаздар нарығында қызметті жүзеге асыруға 2018 жылғы 10 шілдедегі № 3.2.235/12 мемлекеттік лицензия

303 қоңырау шалу

Тех. қолдау: support_invest@bcc-invest.kz Заңды тұлғаларға қызмет көрсету ішкі. нөмірі: +7(727) 244-32-32 / 39022, 39033, 39041

Серіктестер және сыртқы агенттермен жұмыс. нөмірлері: 39062, 39012 agent@bcc-invest.kz

Дисклеймер. Маңызды ақпарат.

«BCC Invest» АҚ клиенттері үшін тәуекелдер туралы ақпарат. Бұл материалды «BCC Invest» АҚ қызметкерлері дайындады және тек ақпараттық мақсатта таратылады. Бұл материалды тарату инвестициялық консалтингтік қызметті құрмайды. Осы материалда келтірілген ақпарат жеке инвестициялық ұсыныс болып табылмайды. Бұл ақпарат ағымдағы қаржылық немесе коммерциялық оқиғалардың толық көрсетілімі болып табылмайды және оны сол күйінде пайдалану мүмкін емес. Бұл материалды алушы шешім қабылдау үшін тек берілген ақпаратқа сенбеуі керек. Осы материалда болуы мүмкін есептеулерді, тарихи деректерді және басқа ақпаратты BCC Invest қызметкерлері жалпыға қол жетімді ақпарат көздерінен алынған мәліметтер мен мәліметтер негізінде дайындайды. BCC Invest мұндай ақпараттың толықтығын, дәлдігін және сенімділігін тексермейді және тексеруге міндетті емес. BCC Invest ұсынған кез келген ақпаратты клиент тек өз қалауы бойынша және өз тәуекелімен пайдаланады. BCC Invest ұсынған ақпарат кез келген бағалы қағаздарды сатып алу және/немесе сату міндеттемесі, мәміле жасауға ынталандыру немесе клиентке инвестициялар, салық және құқықтық мәселелер, оның ішінде мәміленің клиенттің нақты мақсаттарына сәйкестігі бойынша ұсыныс болып табылмайды. Бағалы қағаздармен, оның ішінде шетелдік бағалы қағаздармен, валюталық және туынды қаржы құралдарымен әр түрлі базалық активтері бар операцияларды жүзеге асырмас бұрын (бұдан әрі – «Қаржы Құралдары»), осы ақпаратты алушылар көрсетілген қаржы құралдарын сипаттайтын құжаттармен танысуы керек (эмиссия проспектісі және т.б.) және Қаржы Құралдарымен мәміле жасамас бұрын олардың қаржылық, заңгерлік, салықтық, бухгалтерлік және басқа кеңесшілерімен жан-жақты консультациялар жүргізуі тиіс. Қаржы Құралдарымен жасалатын операцияларға қатысу белгілі бір тәуекелдерді тудырады, олар үшін BCC Invest жауапкершілікке тартылмайды, өйткені олар тараптардың ақылға қонымды бақылауынан тыс және олардың мұндай тәуекелдердің салдарын болжау және алдын алу қабілеті шектеулі немесе мүмкін емес. Әлеуетті Қаржы Құралдары (опциондар, фьючерстер және т.б.) барлық инвесторлар үшін жарамсыз болуы мүмкін және бұл құралдармен сауда жасау қауіпті болып саналады. Өткен нәтижелер болашақ нәтижелердің кепілі емес. Инвестициялардың құны төмендеуі немесе ұлғаюы мүмкін, ал инвестор бастапқы салымдарының сомасын өтей алмайды. Кейбір инвестициялар бағалы қағаздар нарығының өтімсіздігіне немесе қайталама нарықтың (инвесторлардың қызығушылығының) болмауына байланысты мүмкін болмай қалуы мүмкін, сондықтан инвестицияларды бағалау және инвесторлардың тәуекелдерін анықтау сандық бағалауға сәйкес келмеуі мүмкін. Өтімді емес бағалы қағаздарға салынған инвестициялар тәуекелдің жоғары дәрежесін білдіреді және мұндай тәуекелдерге сезімтал емес және инвестицияларды қолма-қол ақшаға оңай және жылдам айырбастауды қажет етпейтін тәжірибелі инвесторлар үшін ғана жарамды. Шетел валютасында көрсетілген бағалы қағаздар валюта бағамдарына байланысты ауытқуларға ұшырайды, бұл инвестициялардың құнына немесе бағасына, сондай-ақ инвестициялардан алынған кірістерге теріс әсер етуі мүмкін. Инвестициялардың бағасына, құнына немесе кірісіне әсер ететін басқа тәуекел факторларына саяси, экономикалық, несиелік, сондай-ақ нарықтық тәуекелдер жатады, бірақ олармен шектелмейді. Дамушы нарықтарға және дамушы нарықтардың бағалы қағаздарына салынған инвестициялардың тәуекелі жоғары, сондықтан инвесторлар инвестиция жасамас бұрын мұқият алдын-ала зерттеулер жүргізуі керек. Клиент Қаржы Құралдарының қатысуымен операциялар жасау мүмкіндігін дербес бағалауы керек. Егер оның экономикалық және құқықтық мәні, құжаттамасы, шарттары және онымен байланысты тәуекелдер түсініксіз болып қалса немесе клиенттің мақсаттарына, ниеттеріне және үміттеріне сәйкес келмесе, клиент мәміле жасамауы керек. Қаржы Құралдарымен жасалатын операцияларға қатысу елеулі қаржылық және басқа тәуекелдерді қамтуы мүмкін. Осы себепті, бұл операциялар байланысты тәуекелдерді қабылдауға дайын және ықтимал қаржылық шығындарды көтеруге қабілетті жеке тұлғаларға арналған. Кез келген транзакцияны жасамас бұрын, клиент тиісті транзакцияны жасаумен байланысты тәуекелдерді түсінуін және кез келген сценарий бойынша қабылданған міндеттемелерді орындау үшін қажетті қаржылық және басқа ресурстардың болуын қамтамасыз етуі керек. Қаржы нарығындағы операцияларға қатысты шешімдер қабылдаған кезде қаржы құралдарына инвестициялау күтілетін кірістілікке қол жеткізбеу, инвестицияланған қаражаттың ішінара немесе толық жоғалуына, сондай-ақ ықтимал шығындарға ұшырау қаупін тудыратынын ескерген жөн. Қаржы құралдары банктік салымдар болып табылмайды және олармен байланысты тәуекелдер қолданыстағы заңнамаға сәйкес сақтандырылмайды. Инвестициялардың қайтарымы мен қаржы құралдарына салынған инвестициялардың табыстылығына үкімет кепілдік бермейді. Күтілетін оң нәтижелер туралы ақпарат болжам ретінде қарастырылуы мүмкін. Өткен инвестициялардың нәтижелері болашақ нәтижелерді анықтамайды, активтердің құны өсуі де, төмендеуі де мүмкін. BCC Invest ешқандай кепілдіктер бермейді және берілген ақпарат негізінде клиент ала алатын қаржылық нәтижелерге қатысты жауапкершілікті өз мойнына алмайды. «Инвестициялық пай қорларына инвестициялау кезіндегі тәуекелдер туралы ақпарат» Бұл материалды BCC Invest қызметкерлері дайындады және тек ақпараттық мақсатта таратылады. Осы материалда келтірілген ақпарат жеке инвестициялық кеңес беру, мәмілелер жасауға ынталандыру немесе инвестициялық, салықтық және құқықтық мәселелер бойынша ұсыныстар, оның ішінде мәміленің алушының нақты мақсаттарына сәйкестігі болып табылмайды. BCC Invest ақпарат беретін инвестициялық пай қорының пайларымен (бұдан әрі – қаржы құралдары немесе пай/пай) операцияларды жүзеге асырар алдында осы ақпаратты алушылар көрсетілген қаржы құралдарын, инвестициялық декларацияны және инвестициялық пай қорының ережелерін сипаттайтын құжаттармен танысуы, сондай-ақ қаржы құралдарымен мәмілелер жасамас бұрын олардың қаржылық, заңгерлік, салықтық, бухгалтерлік және басқа кеңесшілерімен жан-жақты консультацияларға жүгінуі керек. Қаржы құралдарымен мәмілелер жасау белгілі бір тәуекелдерді қамтиды, олар үшін жауапкершілікті BCC Invest-ке жүктеуге болмайды, өйткені олар Тараптардың ақылға қонымды бақылауынан тыс және олардың мұндай тәуекелдердің салдарын болжау және алдын алу мүмкіндігі шектеулі немесе мүмкін емес. Ақпарат алушы қаржы құралдарымен мәмілелер жасау мүмкіндігін дербес бағалауы тиіс. Егер оның экономикалық және құқықтық мәні, құжаттамасы, шарттары және онымен байланысты тәуекелдер түсініксіз болып қалса немесе ақпарат алушының мақсаттарына, ниеттері мен үміттеріне сәйкес келмесе, ақпарат алушы мәміле жасамауы керек. Пайлармен операция жасау туралы шешім қабылдағанда, қаржы құралдарына инвестициялау күтілетін кірісті алмау, инвестицияланған қаражаттың бір бөлігін немесе тіпті барлығын жоғалту, ықтимал шығындар мен шығындар қаупін тудыратынын ескеру қажет. •Пайлардың құны өсуі немесе төмендеуі мүмкін. •Өткен инвестициялау нәтижелері болашақ кірісті анықтамайды. •Мемлекет инвестициялық қорларға салынған инвестициялардың кірістілігіне кепілдік бермейді. «BCC Invest» АҚ Бағалы қағаздар нарығында қызметті жүзеге асыруға 10.07.2018 жылғы №3.2.235/12 мемлекеттік лицензия.